February 3, 2023

Author: Srinivas Abhilash

What are the Legal Aspects of Farmland Ownership?

Farmland ownership refers to the legal rights and responsibilities associated with owning land used for agricultural production, especially for farmers and landowners. It can include land used for crops, and livestock, issues related to property rights, zoning, land use regulations, tax laws, etc.

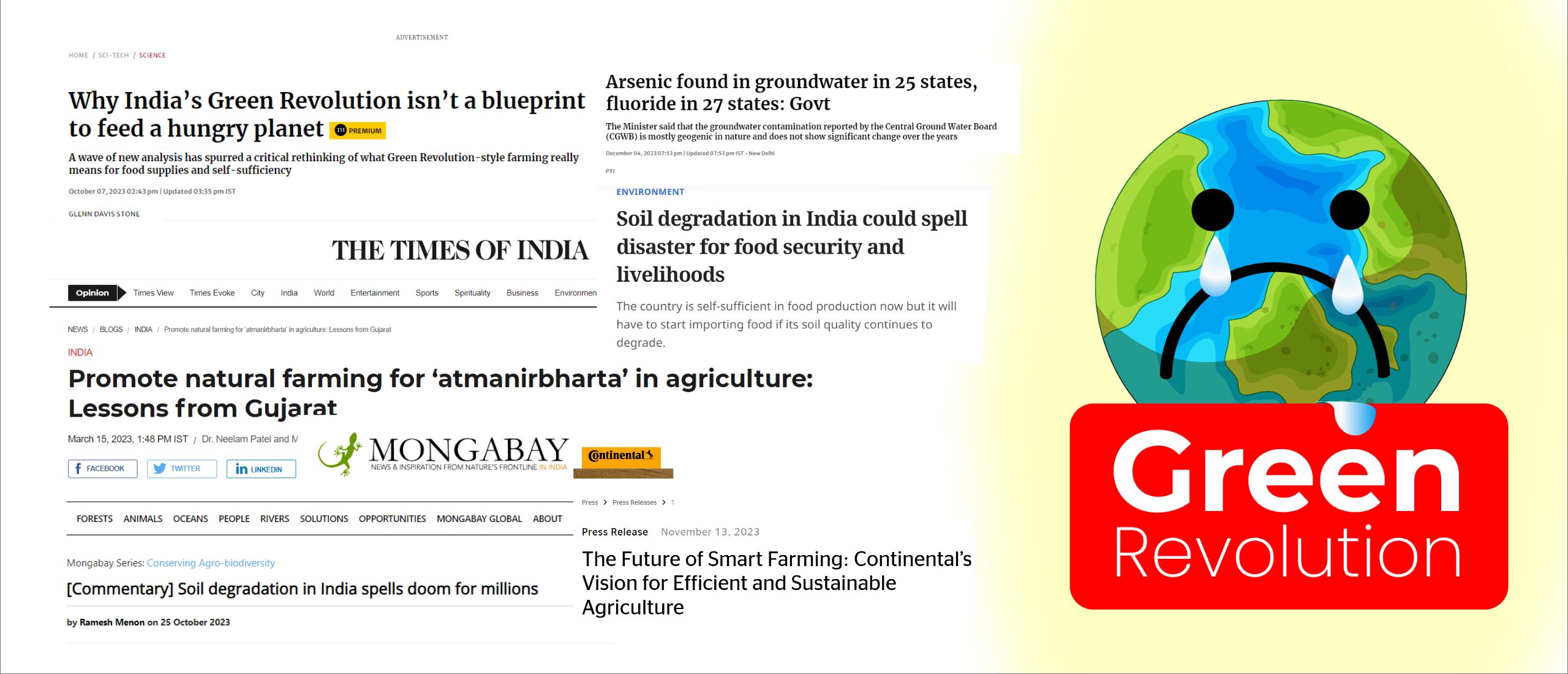

Real Estate and Scams

The Indian real estate sector is growing, and so are the scams and frauds associated with it. Real estate scams run the entire gamut, from legal frauds, and fly-by-night operators to false promises and untenable buy-one-get-something-free offer. People invest in real estate, a flat/apartment, or a farm plot for various reasons ranging from long-term land security to building equity; to the land, they can pass down to their children. Joint ventures, wholesaling, property management, and many more such terms linger around and trigger a lot of anxiety in the quest to be thoughtful and make rational decisions. If not invested carefully and judiciously, the hard-earned money can get washed away in no time.

When it comes to avoiding real estate scams, knowledge is power. By being aware of the potential risks, you can protect yourself from being a victim. Arm yourself with some of the common warning signs listed below, and protect yourself from any real estate scams by staying informed.

Scams and Agricultural Land

Buying a piece of agricultural land compared to a regular plot has a lot of challenges and requires additional due diligence. The big question is, how do you avoid these challenges?

Unlike flats or apartments, the land is more vulnerable to illegal occupation, especially if left unattended. There are many parameters to be checked and verified before purchasing the land, irrespective of the developer. Exercise a little caution, and conduct due diligence and know-how to avoid real estate fraud by educating yourself about the most common mistakes and essential points to remember before investing in farmland in India.

Legal Aspects of Farmland Ownership

-

-

Title Verification to confirm Land Ownership

- The term “Title” in real estate parlance refers to the rights resulting from legitimate property ownership. A free and clear title is undeniable evidence of ownership. The term free and clear refers to ownership without legal encumbrances, such as a lien or mortgage. Hence title verification is the process to check if the transferor is the legal owner of the property and has the authority to transfer ownership. Verification of farmland titles should date to a minimum of 40 years from the date of purchase. Tracing ownership should always begin with probing into the earliest document recorded. There should be no minor as the land owner. Companies such as Hosachiguru guarantee 100% secure, clear, and free land titles. Thorough checking of farmland titles tops the checklist and is a must-have before investing. If and when ignored will lead to legal complications and financial troubles. The advantage of having a free and clear title is that the property will act as collateral for loans or other financing/investment ventures. Hence it is paramount to ensure that no disputes are over the title and the land area.

-

Check Encumbrance Certificate (EC)

- Popular encumbrances against real estate property include liens, easements, leases, mortgages, or restrictive covenants. Encumbrances impact the transferability and use of subject properties.

- This document is instrumental in knowing the encumbrances concerning the property for a specific duration.

- While transferring the legal titles, investors should verify if EC has the name of the same person with whom they are dealing.

-

Property Tax Receipts and Bills

It is essential to ask the seller for previous property tax receipts and other bills related to the plot. It will help to avoid taxation issues in the future. It is also the responsibility of the buyer to seek all previous documents, invoices, and tax receipts to ensure there are no outstanding dues on the property.

-

Property Tax Receipts and Bills

RTC is an annual document that is very crucial in title verification. It discloses the ownership, possession, tenancy, soil type, number of trees on the land, and other details. It is advisable to procure the document for the past 40 years from the date of purchase as it discloses the flow of ownership annually.

-

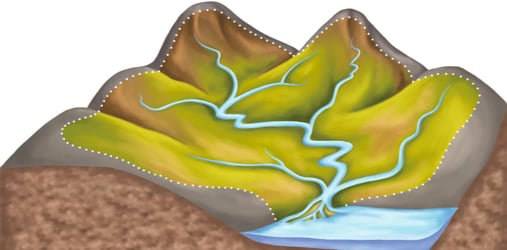

Land Measurement Certificate

Before buying agricultural land, the measurements of the exact agricultural plot area need to be conducted by the surveyor to be able to mark the boundaries, and only then a land measurement certificate is to be issued. It states that the land measurements are as per the data mentioned in the title deed.

-

- In the end, it all bottles down to the Title alone. The property holds no value with an improper Title. One will not have 100% rights on buy, sell, or mortgage transactions. Therefore, it is essential to carefully consider whether you possess a clear, marketable title before investing in real estate. It determines that your ownership rights are free from uncertainties, risks, and quiet claim encumbrances and defects.

- Some other essential documents which need due diligence too to make the process of acquiring land free from any problems are as follows:

- Index of land

- Mutation Extract

- Family Tree History

- Patta Book

- Khata Certificate

- Survey Documents that include: Survey sketch, Akarband Extract, Hissa Tippani Book Extract, Tippani, Phodi Extract, Hudbust Register Extract, Atlas & Village Map

- The term “Title” in real estate parlance refers to the rights resulting from legitimate property ownership. A free and clear title is undeniable evidence of ownership. The term free and clear refers to ownership without legal encumbrances, such as a lien or mortgage. Hence title verification is the process to check if the transferor is the legal owner of the property and has the authority to transfer ownership. Verification of farmland titles should date to a minimum of 40 years from the date of purchase. Tracing ownership should always begin with probing into the earliest document recorded. There should be no minor as the land owner. Companies such as Hosachiguru guarantee 100% secure, clear, and free land titles. Thorough checking of farmland titles tops the checklist and is a must-have before investing. If and when ignored will lead to legal complications and financial troubles. The advantage of having a free and clear title is that the property will act as collateral for loans or other financing/investment ventures. Hence it is paramount to ensure that no disputes are over the title and the land area.

-

-

-

Fencing, Access Paths, and Demarcation

- Robert Frost once said that “Good Fences make good neighbors.” Farmlands are fenced and demarcated to secure ownership rights and protect properties from intrusion. Investors should refrain from investing their time, money, and effort in farmland properties that do not have full-fledged fencing, clear access paths, and demarcations.

-

-

-

State Laws

- Since agricultural lands fall under state jurisdiction, the rules may vary from state to state. Thus, one must review the latest laws before making any agricultural land-buying decision. Laws, legal procedures, restrictions on land ownership, land ceiling, and stamp duties vary from state to state.

- Restrictions on Land Purchase – In some states in India, it is allowed to purchase agricultural land, regardless of their profession, whereas, in other states, only agriculturists are.

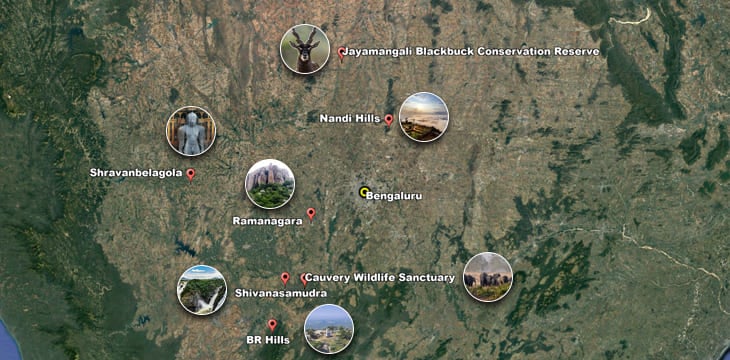

- In 2020, the Karnataka government removed limitations on non-agriculturists for buying and selling agricultural plots, thereby repealing a decades-old rule. Any Indian resident, institution, corporate, or academic establishment can purchase farmland in Karnataka regardless of annual revenue from non-agricultural sources.

- Land Ceiling

- It is the maximum agricultural land that a buyer can own, and the norms vary substantially across territories.

-

-

Physical Land Survey and Site Inspection

- To establish clarity, precision, and transparency, physical verification of the land with the assistance of surveyors and government officials needs to get conducted. Hosachiguru has various teams of experts who examine the reports and vet the documents and lands; leaving no stone unturned. Doing this will allow having a clear say on the legal status and would help in analyzing the boundaries and nature of abutting lands as well.

Farmlands VS Flats/Apartments

Farmlands

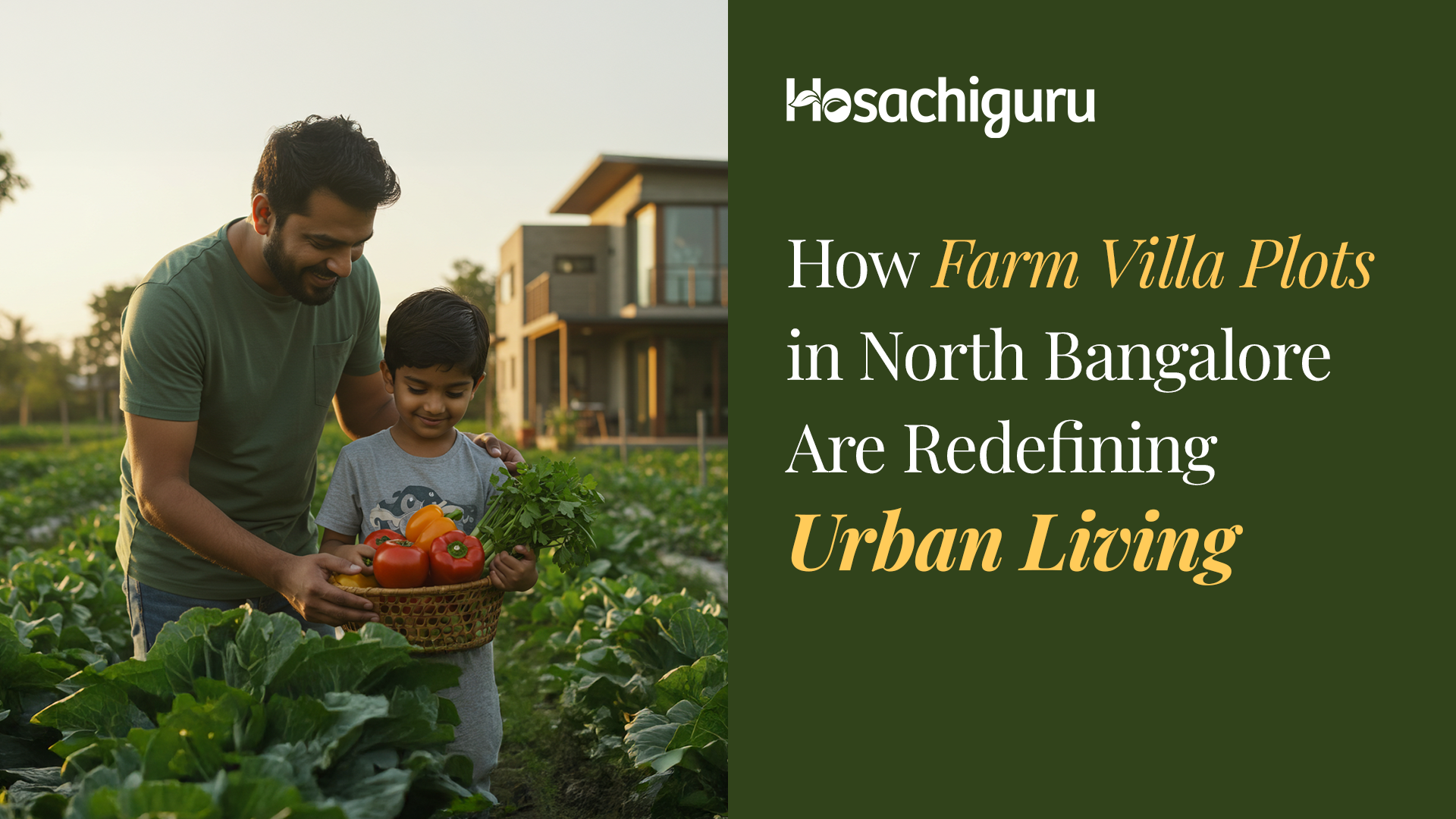

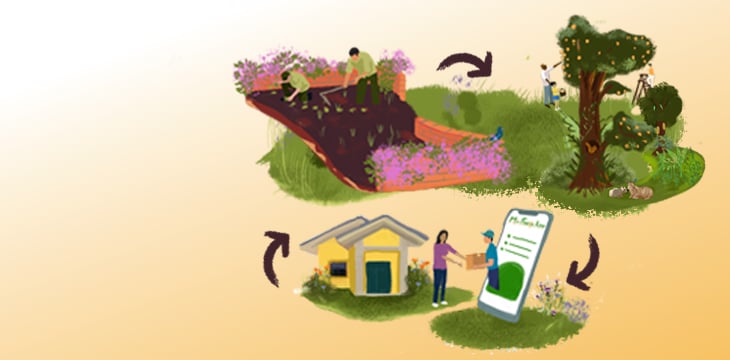

Buying farmland is a lifestyle investment and a reliable, age-old hedge against inflation. It provides an opportunity for individuals to live on and work the land and be self-sufficient. Many urbanites buy farmland to escape the city, be closer to nature and live a healthier, more holistic lifestyle. This investment allows individuals to control their food production, grow crops, and live sustainably. Additionally, owning farmland provides a sense of community and connection to the land. It has a sense of accomplishment and fulfillment; that comes from making a parcel of land productive by growing natural, healthy food.

Flat/Apartment

An investment in a flat or an apartment can depreciate over time. Factors such as wear and tear, aging infrastructure, changes in local market conditions, and consumer preferences can all contribute to a decline in value. Additionally, if the building or neighborhood falls out of favor or becomes less desirable, the property value may decrease.

Old buildings cannot match the amenities and features of new buildings. Hence, making it less desirable to potential buyers or renters. It would have reached the saturation point for the investment value that indicates the maximum growth potential of the new building that one can realistically expect.

The cost of an old building in a posh locality will likely be lower than a new building. New buildings are expensive to construct. When we purchase a flat or an apartment, the major share of the price paid typically goes toward the cost of construction, and a very minimal amount goes toward the cost of the land.

Conclusion

Considering all the discussed points in detail, one can confidently explore agricultural land investments independently. However, informed consumers can still be susceptible to scams. Hence, it is always advisable to go with experts or seek an expert opinion that can ensure problem-free transactions.

Hosachiguru’s in-house advocates put in tremendous efforts to ensure the above legal aspects are carefully adhered to, thereby ensuring a safe investment opportunity for our co-farmers. Adding to it, the power of Talkinglands, an in-house tool that auto-populates publicly available information, ensures complete transparency towards the land you own mapped onto the part of the village/survey. Before investing, it is advisable to check if the developer or land provider is giving such tools to understand the land better.

Only SEBI-registered companies have the authority to talk about returns on investment. No other company is entitled to promise returns and hence farmland companies promising returns are not legit. If anyone offers to manage your land with short-term income from crops, be wary of this as it could be a desperate move from a developer to sell the property. People get tempted by no maintenance and end up with a bad investment. Don’t lose your principal in the quest for profits or returns. In the end, the land is the best investment on Earth. Pay in full and experience it in a wholesome way.